Page 130 - IRSEM_Main Book

P. 130

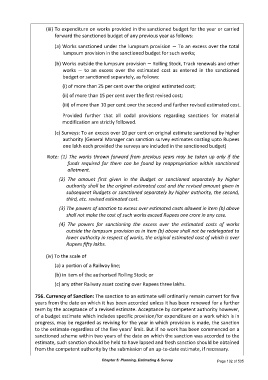

(iii) To expenditure on works provided in the sanctioned budget for the year or carried

forward the sanctioned budget of any previous year as follows:

(a) Works sanctioned under the lumpsum provision − To an excess over the total

lumpsum provision in the sanctioned budget for such works;

(b) Works outside the lumpsum provision − Rolling Stock, Track renewals and other

works − to an excess over the estimated cost as entered in the sanctioned

budget or sanctioned separately, as follows:

(i) of more than 25 per cent over the original estimated cost;

(ii) of more than 15 per cent over the first revised cost;

(iii) of more than 10 per cent over the second and further revised estimated cost.

Provided further that all codal provisions regarding sanctions for material

modification are strictly followed.

(c) Surveys: To an excess over 10 per cent on original estimate sanctioned by higher

authority (General Manager can sanction survey estimates costing upto Rupees

one lakh each provided the surveys are included in the sanctioned budget)

Note: (1) The works thrown forward from previous years may be taken up only if the

funds required for them can be found by reappropriation within sanctioned

allotment.

(2) The amount first given in the Budget or sanctioned separately by higher

authority shall be the original estimated cost and the revised amount given in

subsequent Budgets or sanctioned separately by higher authority, the second,

third, etc. revised estimated cost.

(3) The powers of sanction to excess over estimated costs allowed in item (b) above

shall not make the cost of such works exceed Rupees one crore in any case.

(4) The powers for sanctioning the excess over the estimated costs of works

outside the lumpsum provision as in item (b) above shall not be redelegated to

lower authority in respect of works, the original estimated cost of which is over

Rupees fifty lakhs.

(iv) To the scale of

(a) a portion of a Railway line;

(b) in item of the authorised Rolling Stock; or

(c) any other Railway asset costing over Rupees three lakhs.

756. Currency of Sanction: The sanction to an estimate will ordinarily remain current for five

years from the date on which it has been accorded unless it has been renewed for a further

term by the acceptance of a revised estimate. Acceptance by competent authority however,

of a budget estimate which includes specific provision/for expenditure on a work which is in

progress, may be regarded as reviving for the year in which provision is made, the sanction

to the estimate-regardless of the five years' limit. But if no work has been commenced on a

sanctioned scheme within two years of the date on which the sanction was accorded to the

estimate, such sanction should be held to have lapsed and fresh sanction should be obtained

from the competent authority by the submission of an up-to-date estimate, if necessary.

Chapter 5: Planning, Estimating & Survey Page 102 of 535